Securing banking and payment journeys

Today’s financial institutions are undergoing a massive transformation and seeking out multichannel strategies to enrich client relationships. IDEMIA’s payment and banking technologies enable banks, FinTechs, payment networks, retailers and transport operators to modernize their services and offer their customers safe and innovative journeys.

-

1,900

financial institutions and FinTechs trust us (including most of the world’s largest banks)

-

400M+

tokens provisioned for different token requestors

-

50M+

payment card PIN codes managed electronically

Delivering essential financial services around the globe

IDEMIA’s commitment to securing payment diversity and to creating the payment solutions of tomorrow has helped us become the undisputed market leader in payment cards issuance and digital payment services. Our encryption technologies and secret key management solutions have become mission critical for the world’s biggest companies. We have worked to reduce payment fraud—both online and in-store—and for the past decade, we have driven EMV and contactless migration.

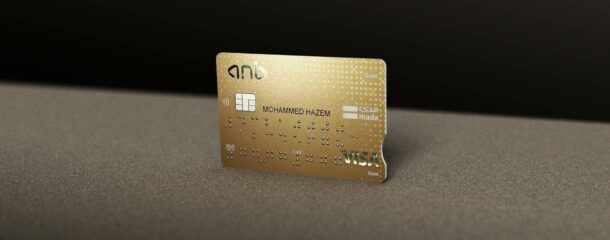

Reinventing the cardholder experience

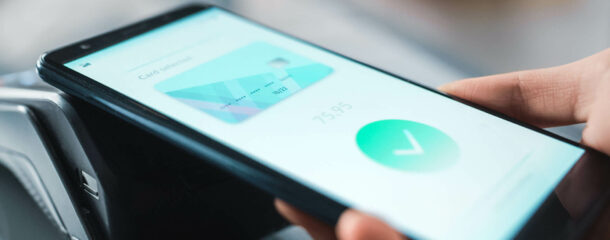

As retail banking evolves, we help traditional banks and FinTechs leverage the payment card as a tool for brand and loyalty reinforcement. Our metal cards, for instance, are designed for consumers looking for premium products. We also address the expectation of cardholders for greener financial services, and are proud to support our clients in their sustainability initiatives with eco-friendly payment products, services, processes and carbon emission offsetting programs. Additionally, we guarantee highly secure and enhanced payment and banking journeys in-store and online to tech-savvy consumers by leveraging biometrics through our biometric payment cards and digital wallet solutions.

Bridging the physical and digital worlds to transform financial services

At IDEMIA, we truly believe in the complementarity of the physical and digital worlds, and we know that—above all—the financial services business is built on trust. As bank and FinTech customers, as well as public transport users, increasingly benefit from digital financial services and mobile payment solutions, they want assurance that their personal data remains protected. In combining tokenization techniques with identity proofing and authentication technologies, we offer financial service providers a holistic approach to protect all payment credentials, and ensure reliability, speed, and convenience in all the customer journeys—from the physical to the digital world, and the other way around.

At IDEMIA, we make it our mission to ensure that our customers have streamlined and highly adaptable financial solutions—guarded by ironclad security measures—whenever and wherever they need. After all, convenience and fluidity are nothing if not accompanied by peace of mind.

Discover our products and services

Every day technology, simplifies our lives just a bit more than the day before. IDEMIA promises to ensure that with a tap of our smartphone or a fingerprint scan, we can prove our identities, open a bank account, define our PIN code, add our banking card to a new mobile wallet, or make a payment—effortlessly, and in total trust.

Related videos

Related content