Enabling secure and innovative payment experiences via payment tokenization

In today’s digital-first world, digital-first banking solutions are a must for banks and FinTechs to provide digital-native experiences that offer more transparency and control to cardholders, independently of their card form factor.

Digital-first does not mean digital only. It means blending digital and physical and taking the best from both to create unique customer journeys. With digital-first banking and card services, IDEMIA addresses consumers’ need for immediate, convenient and secure experiences and enables issuers to create value “beyond” the card to unlock a deeper relationship with the cardholder.

Services range from remote identity verification for opening an account to customizing the physical card directly from the mobile banking app (e.g. selecting PIN code and artwork), activating the card by simply tapping it on the back of your smartphone, or securely displaying card-related data to make online payments without even having to wait for physical card issuance.

IDEMIA’s digital-first banking solutions help banks and FinTechs to deploy digital-first payment strategies, enabling them to provide immediate card issuance and secure digital payment options accessible directly from their mobile banking app. These payment methods include:

With virtual cards, NFC mobile payments and the IDEMIA Token Control service, financial institutions provide their clients with more transparency and control over their spending—cardholders get an overview of all tokens associated with a card (funding PAN) saved on any merchant app or website and enrolled to third-party wallets, along with the ability to manage each token from the mobile banking app.

All of IDEMIA’s digital-first banking and payment services rely on a set of easy-to-integrate APIs and an optional mobile SDK embedded into the card issuer’s mobile banking app. This reduces integration complexities and shortens the time-to-market for a variety of use cases.

With digital-first banking solutions, issuers can onboard new customers, issue virtual cards, and trigger card enrollment to digital wallets or merchant websites with push provisioning from their mobile banking app. They can also provide cardholders with features to fully control their card experience from their smartphones—at all times.

IDEMIA’s digital-first banking services suite helps create a paperless banking experience by providing card-related information directly in the mobile banking app. It creates an effective way of communicating with the cardholder during the card issuance process with real-time notification of card delivery.

Remote identity verification establishes a root of trust to speed up cardholder onboarding and card issuance. In addition, virtual cards and NFC mobile payment options enhance fraud management through tokenization and domain usage restrictions.

End-to-end support for creating numberless cards

IDEMIA supports issuers to create numberless cards from card design and personalization to card activation and PIN retrieval, as well as to issue virtual cards for online and in-store payments.

Everyday multifaceted payments

New payment methods such as SoftPOS applications, e-wallets, and super apps facilitate the consumer experience with contactless payments. This multiplicity of means is transforming the shopping journey.

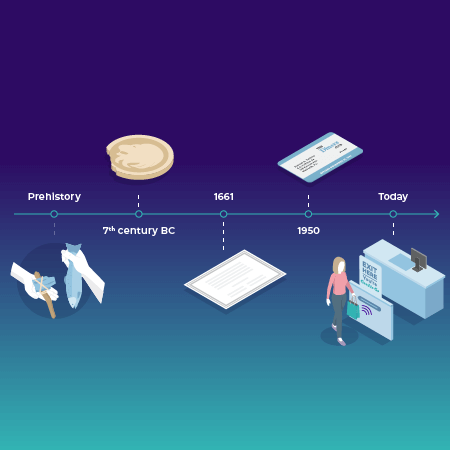

Central Bank Digital Currency (CBDC) explained

This infographic shows how CBDCs are redefining payment eco-system fundamentals as global trends show a shift towards digital and cashless societies.

Latest News

Related content