Turning smartphones and tablets into contactless payment terminals

In the past couple of years, we have witnessed a payment revolution in our daily lives. Today, new payment methods and SoftPOS applications facilitate contactless payments while e-wallets, Buy Now Pay Later (BNPL) options and super apps create a seamless customer experience and continue to redefine the shopping journey. At the same time, the physical payment card, introduced 70 years ago, is no closer to disappearing: it remains an important part of our multiple payment methods.

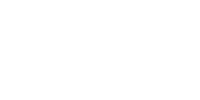

People have been paying for things for as long as there have been things to pay for—but the way we pay has evolved over the course of human history. For the longest time, we paid by bartering, for example trading a chicken for a pot of honey. The world’s first coins date back to the 7th century B.C. during the reign of King Alyattes of the Lydian Empire in minor Asia1. The world’s first paper money (credit notes that could be exchanged for silver coins) were circulated in Sweden in 1661; and the world’s first payment card was introduced in 1950 in New York City. Until fairly recently, the most significant change in everyday payments for many people around the world was the slow but steady movement from cash to card. A small, but mighty evolution.

People have been paying for things for as long as there have been things to pay for—but the way we pay has evolved over the course of human history. For the longest time, we paid by bartering, for example trading a chicken for a pot of honey. The world’s first coins date back to the 7th century B.C. during the reign of King Alyattes of the Lydian Empire in minor Asia1. The world’s first paper money (credit notes that could be exchanged for silver coins) were circulated in Sweden in 1661; and the world’s first payment card was introduced in 1950 in New York City. Until fairly recently, the most significant change in everyday payments for many people around the world was the slow but steady movement from cash to card. A small, but mighty evolution.

It is only in the last few years that we have witnessed a real payment revolution: an ever-increasing amount of new payment methods – and new channels – to pay and get paid. Think about shopping and simply walking out from an Amazon Go store without any payment interaction, or visiting your favorite coffee shop where your pre-ordered (and prepaid) latte macchiato sits on the counter waiting for you (22% of Starbucks’ Q3 2020 transactions were mobile orders2). Imagine your printer can detect low ink levels and order new cartridges that are paid for without any human intervention3. It’s no wonder then that 70% of millennials believe the way they pay for things will be totally different in five years4. Below we will look at some of these new payment methods in greater detail.

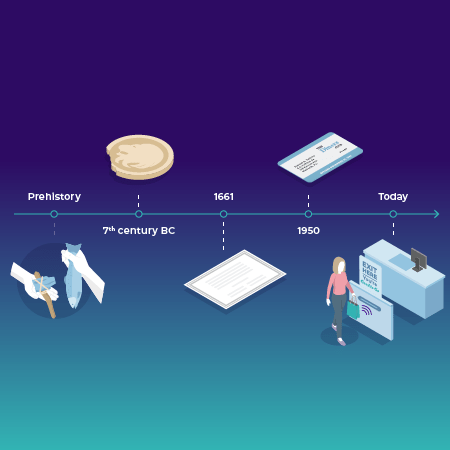

If you walked into a random store anywhere in the world a few years ago, you probably would have seen close to 100% of the customers paying with cash or by swiping or dipping a contact-only payment card into a POS terminal. Walk into that same store today and there is a fair chance that many customers now pay by tapping their contactless card or their smartphone (or by scanning a QR-code, depending on where you are). Some might even tap a wearable such as a wristband or a key-fob. Today, you can pay back a friend with a peer-2-peer app, whenever and wherever it suits you—your friend receives the money from your bank account instantly. Instead of writing a check, you might also pay your plumber by tapping your card on his smartphone with a SoftPOS application (or on an mPOS device). You may even pay for gas from your car’s infotainment system rather than using the pump’s POS terminal.

If you walked into a random store anywhere in the world a few years ago, you probably would have seen close to 100% of the customers paying with cash or by swiping or dipping a contact-only payment card into a POS terminal. Walk into that same store today and there is a fair chance that many customers now pay by tapping their contactless card or their smartphone (or by scanning a QR-code, depending on where you are). Some might even tap a wearable such as a wristband or a key-fob. Today, you can pay back a friend with a peer-2-peer app, whenever and wherever it suits you—your friend receives the money from your bank account instantly. Instead of writing a check, you might also pay your plumber by tapping your card on his smartphone with a SoftPOS application (or on an mPOS device). You may even pay for gas from your car’s infotainment system rather than using the pump’s POS terminal.

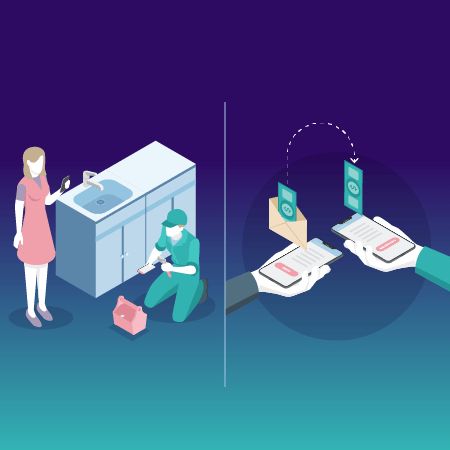

In addition to paying in new ways in traditional channels, it is worthwhile to remember that we also shop in many more channels today than what we did just a few years ago. The rise of e-commerce has been meteoritic, introducing numerous new payment methods. E-wallets as well as Buy Now Pay Later (BNPL) first emerged in the e-commerce channel and then spread to brick and mortar stores. In the traditional online shopping journey, the consumer pays first, and then the goods are shipped. With BNPL, this paradigm is inverted: the consumer first receives the goods, and then pays. This means that not only is there a new channel to shop in (e-commerce); there is also a new point in time when the actual payment occurs (after the goods have arrived).

In addition to paying in new ways in traditional channels, it is worthwhile to remember that we also shop in many more channels today than what we did just a few years ago. The rise of e-commerce has been meteoritic, introducing numerous new payment methods. E-wallets as well as Buy Now Pay Later (BNPL) first emerged in the e-commerce channel and then spread to brick and mortar stores. In the traditional online shopping journey, the consumer pays first, and then the goods are shipped. With BNPL, this paradigm is inverted: the consumer first receives the goods, and then pays. This means that not only is there a new channel to shop in (e-commerce); there is also a new point in time when the actual payment occurs (after the goods have arrived).

One could argue that an important part of the traditional shopping journey is missing in e-commerce: human interaction. This could explain why live streaming is quickly rising as the next hottest trend in commerce: it is the digital equivalent of going shopping with a friend or chatting with a store associate. As with so many other phenomena, Asia is leading the way in social commerce: in a single day of Alibaba’s shopping festival, Chinese star streamers Li Jiaqi and Viya sold goods worth almost $3B5. Also in Asia, apps that were initially designed for a single purpose (such as social media or ride hailing) have now evolved into so-called “super apps” with numerous additional services and features—a way to extract more value from their large initial following. To facilitate digital payments, many super apps have developed their own 1-click e-wallets, which have become so popular that they are not only used to pay within the app’s ecosystem, but also with in-store merchants.

In a brick-and-mortar environment, consumers typically end their shopping journey by standing in line waiting to pay a cashier behind a counter but this traditional journey is evolving. Let’s imagine that a consumer tries on a black t-shirt, but in the fitting room realizes that black is not their color. With a POS terminal inside or just next to the fitting room, they can scan the t-shirt and see that there are also t-shirts in green available in the store. A tap on “try” on the POS terminal screen, and just a moment later a store employee brings the green t-shirt in their size. The consumer can then select “pay” on the POS screen, and then tap their card to make the payment. In this scenario, the POS terminal is transformed into an informed point of interaction6 ; it eliminates the need to walk up to the checkout counter and wait to pay.

In a brick-and-mortar environment, consumers typically end their shopping journey by standing in line waiting to pay a cashier behind a counter but this traditional journey is evolving. Let’s imagine that a consumer tries on a black t-shirt, but in the fitting room realizes that black is not their color. With a POS terminal inside or just next to the fitting room, they can scan the t-shirt and see that there are also t-shirts in green available in the store. A tap on “try” on the POS terminal screen, and just a moment later a store employee brings the green t-shirt in their size. The consumer can then select “pay” on the POS screen, and then tap their card to make the payment. In this scenario, the POS terminal is transformed into an informed point of interaction6 ; it eliminates the need to walk up to the checkout counter and wait to pay.

In many emerging customer journeys, the act of paying is no longer an isolated event, a separate workflow, a discrete experience or an afterthought—the payment experience becomes part of broader customer journey. Think about taking an Uber: at the end of the ride, you simply step out of the car and hardly notice at all that you actually paid. New payment methods require less action from the consumer while enabling a more integrated, seamless, and frictionless commerce experience. Payment-adjacent financial services, for example credits, are being weaved into the “customer fronting brand” experience via Banking-as-a-Service (BaaS). They are being offered at the exact point in time and at the exact place when the consumer needs it. Think about shopping online and being offered a line of credit on an e-commerce site as you check out—in the form of a BNPL option, for example. This is the exact place you need it, at the exact moment you need it. Now compare this to the more traditional journey of applying for a line of credit long before you actually need it—in other words, not the moment when you need the credit—by going to a bank branch (not the place where you will actually need to use the credit)

In many emerging customer journeys, the act of paying is no longer an isolated event, a separate workflow, a discrete experience or an afterthought—the payment experience becomes part of broader customer journey. Think about taking an Uber: at the end of the ride, you simply step out of the car and hardly notice at all that you actually paid. New payment methods require less action from the consumer while enabling a more integrated, seamless, and frictionless commerce experience. Payment-adjacent financial services, for example credits, are being weaved into the “customer fronting brand” experience via Banking-as-a-Service (BaaS). They are being offered at the exact point in time and at the exact place when the consumer needs it. Think about shopping online and being offered a line of credit on an e-commerce site as you check out—in the form of a BNPL option, for example. This is the exact place you need it, at the exact moment you need it. Now compare this to the more traditional journey of applying for a line of credit long before you actually need it—in other words, not the moment when you need the credit—by going to a bank branch (not the place where you will actually need to use the credit)

Amid this payment revolution, where does the physical payment card stand? Well, the fact is, the physical payment card has never been more widely used than today. RBR forecasts the global card purchase volume to almost double between 2021 and 2026 (from $41 to 75 trillion USD)7. We begin to see the shape of a payment future in which established and new payment methods flourish side by side. If we go back to where we started this article, Sweden (arguably one of the world’s most advanced payment countries) can serve as an illustration of this phenomena: a whopping 73% of the Swedish population over the age of 16 use the e-wallet app Swish on a weekly basis8. But that doesn’t prevent the average Swede from paying with their physical payment card a massive 349 times a year9.

Amid this payment revolution, where does the physical payment card stand? Well, the fact is, the physical payment card has never been more widely used than today. RBR forecasts the global card purchase volume to almost double between 2021 and 2026 (from $41 to 75 trillion USD)7. We begin to see the shape of a payment future in which established and new payment methods flourish side by side. If we go back to where we started this article, Sweden (arguably one of the world’s most advanced payment countries) can serve as an illustration of this phenomena: a whopping 73% of the Swedish population over the age of 16 use the e-wallet app Swish on a weekly basis8. But that doesn’t prevent the average Swede from paying with their physical payment card a massive 349 times a year9.

1 https://www.worldhistory.org/article/797/the-importance-of-the-lydian-stater-as-the-worlds/

2 https://stories.starbucks.com/press/2020/starbucks-provides-financial-report-for-q3-fiscal-year-2020-results/

3 For the initial set-up, for example as the consumer puts a card on file in the cartridge merchants e-shop, there could be an authentication of the cardholder, and certain regulations might require some form of authentication/human consent for the consequent transactions

4 https://www.fraedom.com/508/tech-savvy-millennials-changing-payments-landscape/

5 https://www.calcalistech.com/ctech/articles/0,7340,L-3923290,00.html

6 Worldline, In-store payments re-imagined, 2021

7 Global Payment Cards Data and Forecasts to 2026 (RBR)

8 https://www.swish.nu/newsroom/news/swish-is-the-preferred-payment-method-online-for-the-second-year-in-a-row

9 https://www.riksbank.se/en-gb/payments–cash/payments-in-sweden/payments-in-sweden-2019/the-payment-market-is-being-digitalised/card-payments-still-dominate/most-payments-are-card-payments/